Featured Content

Book

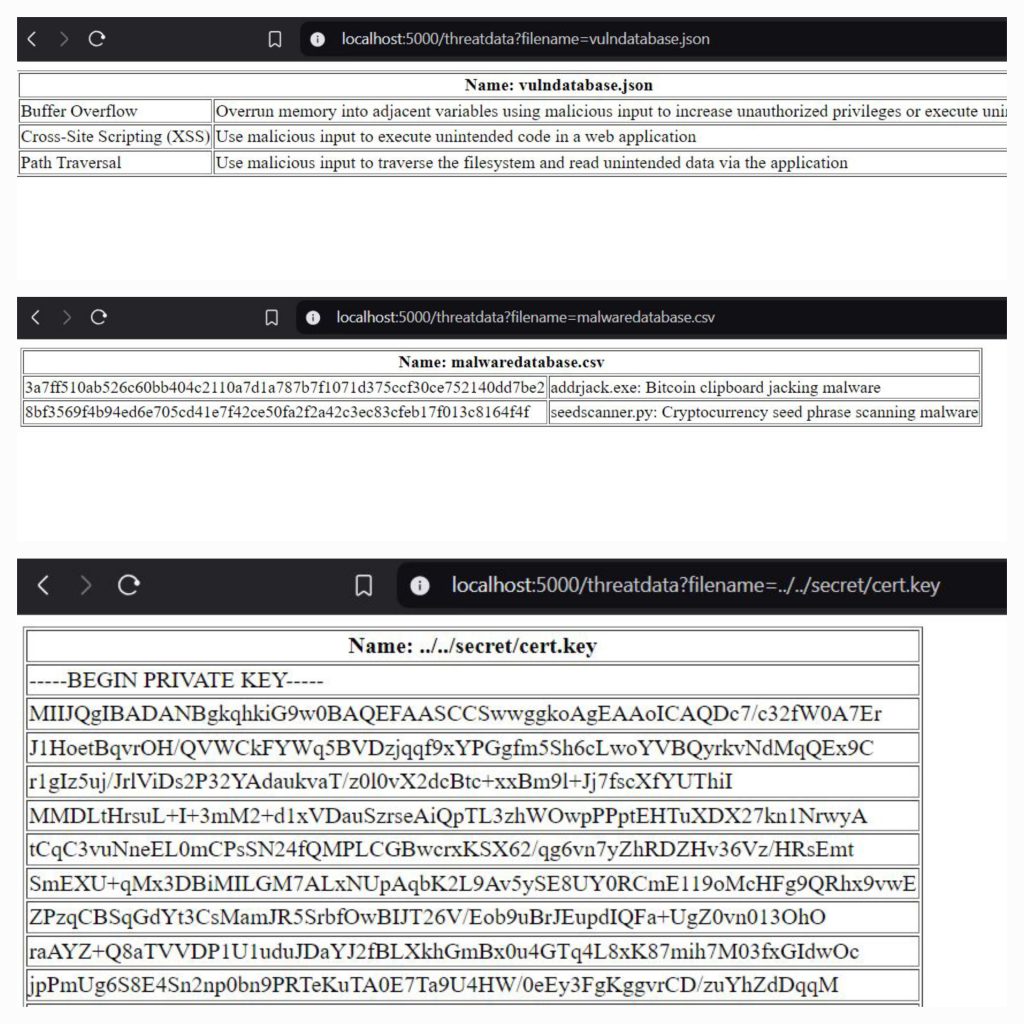

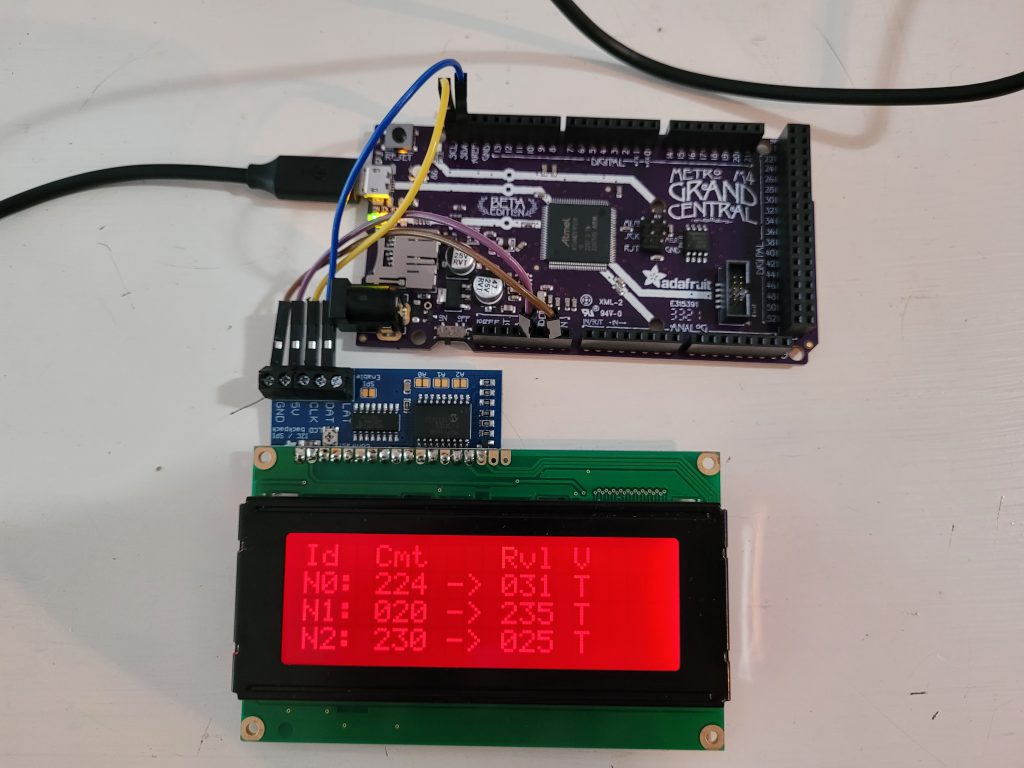

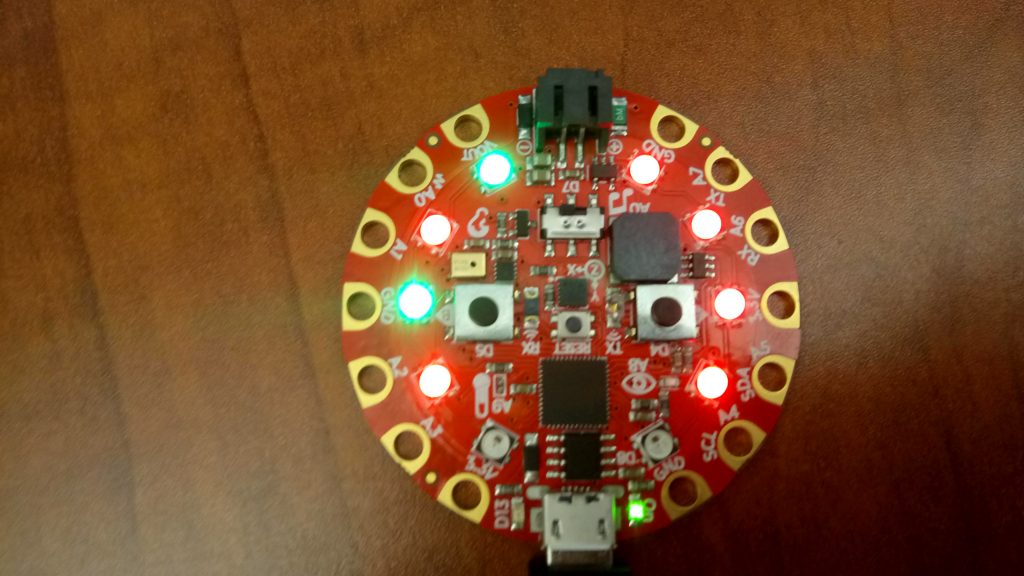

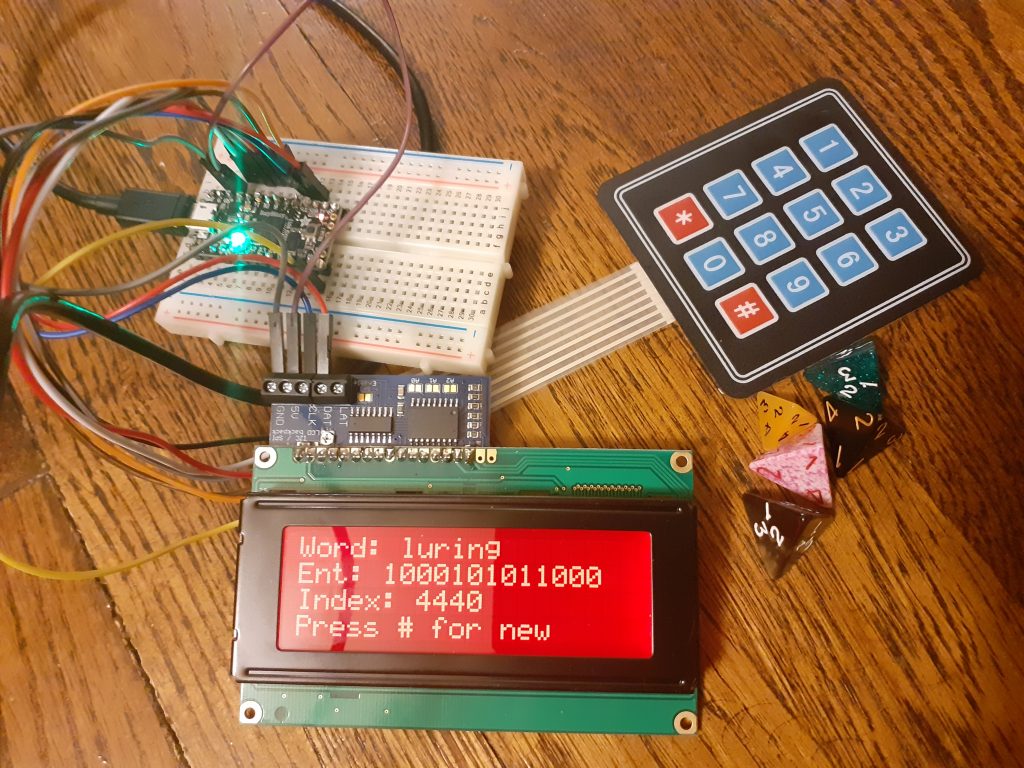

Digital Sovereignty: Protecting Your Crypto Assets Against Common Threats

EBook: https://www.amazon.com/dp/B0F3WJ6MTJ

EBook (B&N): https://www.barnesandnoble.com/w/digital-sovereignty-josh-mcintyre/1147312993?ean=2940182032216

EBook (additional retailers): https://books2read.com/digitalsovereignty

Paperback: https://www.amazon.com/dp/B0F47FMHPK

Paperback (B&N): https://www.barnesandnoble.com/w/digital-sovereignty-josh-mcintyre/1147312993

Direct USD or Crypto (EBook & Paperback): https://chaintuts.store

Open Source Repo (Individual Chapters): https://github.com/chaintuts/crypto-book

Latest Video Tutorials

Latest Article Tutorials

https://github.com/chaintuts/articles/tree/development/pdf

Latest Slides

https://github.com/chaintuts/slides/tree/development/pdf

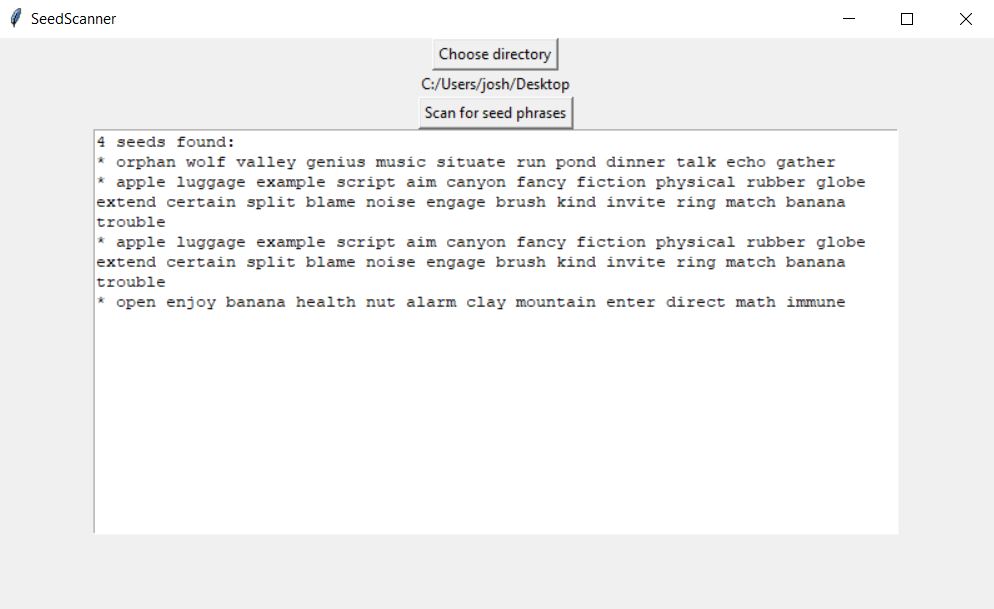

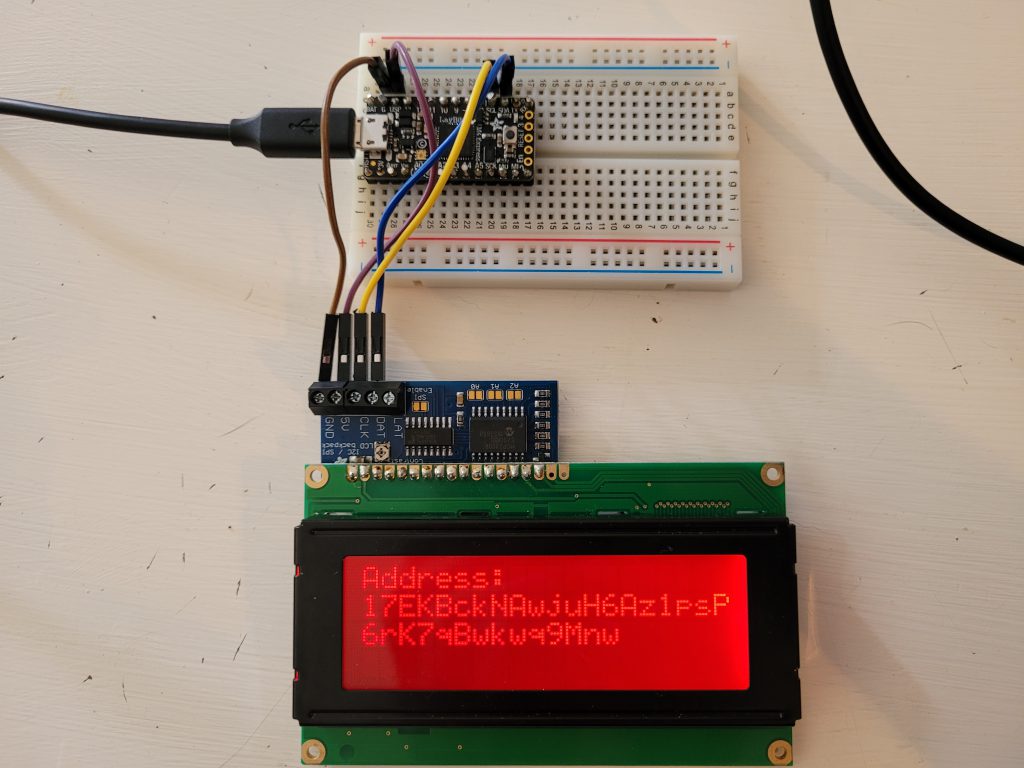

Latest Code